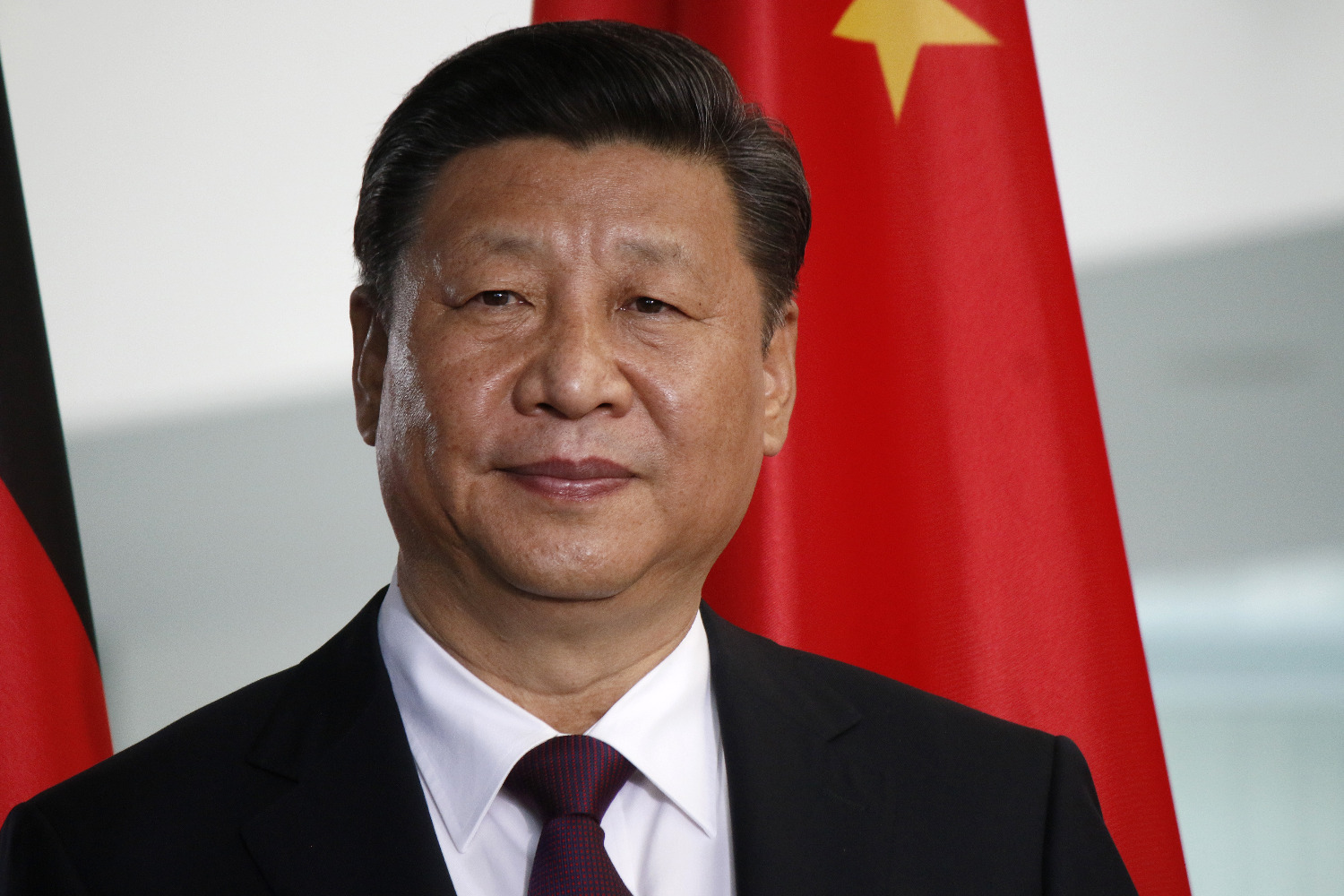

China postponed the release of third quarter GDP data, which could save Xi Jinping embarrassment as he goes for a third term. The pound stabilized and bond yields soared as almost all of the government’s ill-fated “mini-budget” was canceled. The U.S. stock market should open higher, while Bank of America (NYSE:BAC) will report earnings before the open of trading. Oil prices rebounded after a speech by Xi, who reiterated his commitment to a “zero tolerance to virus” policy. Here’s what you need to know about the financial market on Monday, October 17.

1. China postponed the release of Q3 GDP data

China unexpectedly and without explanation postponed the release of its third quarter economic growth data a day before it was due to be released.

It came on the same day that the country’s leader Xi Jinping officially opened the Communist Party Congress, which will break a tradition over the past 30 years by granting Xi another term in office, a move that Western analysts say could deepen the growing gap between China and the West.

In his opening speech, Xi reaffirmed his commitment to a “zero tolerance to the virus” policy that has caused repeated localized quarantines in cities and provinces in the world’s second-largest economy this year, and which is largely responsible for the country missing its official growth target by an embarrassing margin for Beijing’s central “planner.”

Iron ore futures fell sharply on the news, but Chinese stock exchanges are trading mixed and the yuan is little changed.

2. The pound stabilized and bonds went up as Hunt repealed the Truss/Kwarteng budget

The UK’s new Finance Minister Jeremy Hunt announced the scrapping of almost all tax and spending measures proposed by his hapless predecessor, Kwasi Kwarteng, in a desperate attempt to regain market confidence and reverse the recent rise in government bond yields.

The measures proposed by Hunt in outline last weekend cancel the planned tax cuts, restore the planned tax increases, and prepare the way for government spending cuts (at least in real terms) to bring the budget back into balance. Trump’s plans would lead to a funding gap of £72 billion by 2027, according to unpublished provisional estimates by the Office for Budget Responsibility cited by The Times.

UK government bonds reacted favorably ahead of his statement, with yields on 10-year and 30-year securities falling more than 30 basis points each.

3 U.S. stock market will open higher on the back of Fed’s Esther George’s warning about too fast growth; Empire State Manufacturing Index will be released.

The U.S. stock market will start the week with last week’s earnings reports, which generally beat expectations and contained no unpleasant surprises. Bank of America and Bank of New York Mellon (NYSE:BK) will more or less wrap up the banking sector’s contribution to the reporting season before trading opens.

By 06:30 ET (10:30 GMT), the Dow Jones futures were up 347 points, or 1.2%, while the S&P 500 futures were up 1.4% and the Nasdaq 100 futures were up 1.5%.

Sentiment was boosted by comments from Kansas City Fed chief Esther George over the weekend, who again warned of the dangers of raising interest rates too quickly. George’s concerns were a rare example of a dovish approach at a time when most Fed officials are still worried about lagging inflation.

The New York FRB’s report on the Empire State’s manufacturing sector business activity index, due out at 08:30 ET, may provide some context to George’s words.

4- Musk’s change of heart

Over the weekend, Ilon Musk changed course and said that SpaceX will still continue to fund the use of Starlink satellite internet service in Ukraine, albeit without much relief.

5. Oil prices hit a one-week low

Xi Jinping’s speech, which offered little hope for a sustained recovery in Chinese demand, drove crude oil prices to new lows for the week before recovering their losses in the morning in Europe as new UK measures supported risk appetite.

By 06:30 ET, WTI futures were up 0.5% to $85.12 a barrel, while Brent futures rose 0.5% to $92.12 a barrel.

On Friday, positioning data from the CFTC showed another modest increase in net speculative long positions, although they remain at their lowest level in 6 years, suggesting a loss of liquidity in a market that has seen extreme volatility this year as financial conditions tighten.

- support@xii-xwealth.com

- 21021 SPRING BROOK PLAZA DR STE 172, Klein, 77379-5339, TX