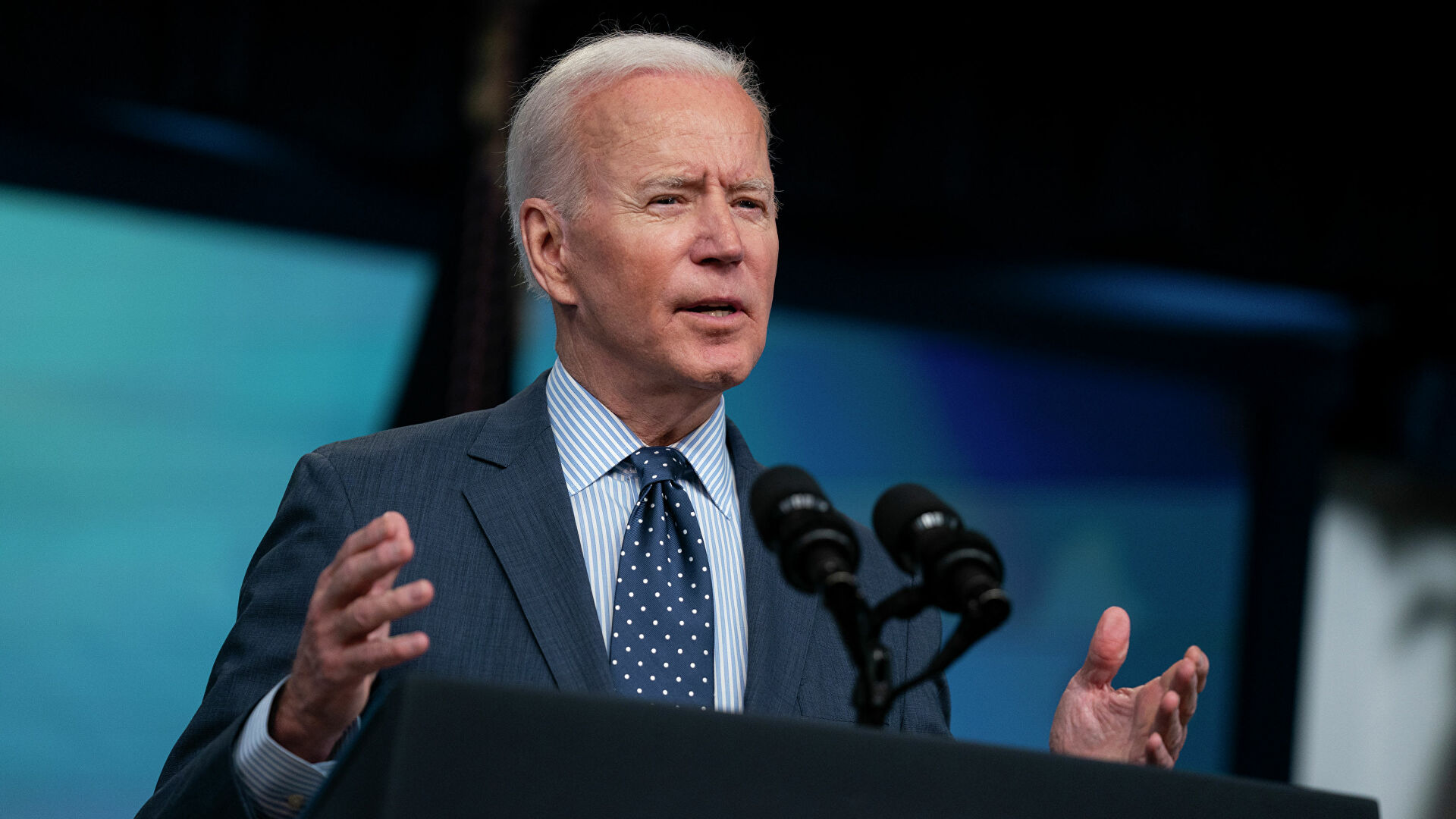

U.S. stock indexes rose on Thursday thanks to shares of chip makers while oil prices fell and U.S. President Joe Biden met with NATO allies to discuss the situation in Ukraine.

Biden called for Russia to be excluded from the G-20 group of countries.

NATO allies meeting in Brussels agreed to strengthen their forces in Eastern Europe to deter Russia. They will send more aid to Ukraine and are trying to increase pressure on Russia with economic and other sanctions.

New data released in the U.S. showed jobless claims last week hit a low not seen since 1969, meanwhile, as the Federal Reserve begins a series of interest rate hikes to calm stronger-than-expected inflation.

Some Fed officials want to see more decisive action on the rate, raising it by a half-point rather than the usual quarter-point, as the Fed did last week. But other members of the monetary policy committee are cautioning against being too tough.

Reuters reported that Russian President Vladimir Putin said Moscow would seek payment in rubles for gas sold to unfriendly countries. His comments shook the energy market, but a number of European leaders, such as Italy’s president, have said they will continue to pay in euros.

Here are 3 things that could affect the market on Friday:

1. Biden in Europe

Biden told reporters at a press conference in Brussels that he is also working to prevent China from coming to Russia’s aid, mentioning that he spoke with Chinese leader Xi Jinping and emphasized the serious consequences for him if China does do so. Biden said China’s economic interests are more focused on the West than Russia.

On Friday, Biden will travel to Poland, a NATO member that has accepted Ukrainian refugees.

2. Fed forecast

Chicago Fed Chairman Charles Evans said Thursday that the central bank needs to raise rates this year and then curb inflation before it becomes a self-fulfilling prophecy. But he also said the Fed should be cautious.

“I think we should be careful not to raise interest rates too sharply, but instead take time to assess whether supply chains are improving and how the military operation in Ukraine is affecting the economy,” Reuters reported.

3. Uber’s steps

Uber Technologies Inc (NYSE:UBER) will begin posting New York City cab information on its app, reversing the direction of the cab giant that has faced opposition from cab groups for years.

The change in course is part of a deal with Creative Mobile and Curb to offer more transportation options. It also helps ease the company’s struggle with a driver shortage.